Crowdfunding has helped more than a million startups raise over $3.2 Billion, and is revolutionizing the way small businesses find the capital they need to grow. By putting the tools for fundraising success in the hands of entrepreneurs like never before, crowdfunding is on track to surpass $5.1 billion in 2013 and continue to transform the landscape of business finance. And though modern crowdfunding is still in its early stages, a number of factors and successes are positioning it to become a more and more attractive funding approach for small businesses.

Peer to peer lending is a method of debt financing that gives individuals the opportunity to lend and borrow money without the need for backing and mediation of a traditional financial institution. In the case of the borrower, the terms of payment may vary depending on the agreement of all parties involved. Investors in a P2P lending vehicle are generally guided by the terms and conditions of the specific company that they are investing with.

The Viva Network is a Peer to Peer financing ecosystem that connects mortgage borrowers with global investors within a borderless, blockchain-secured cloud platform. The Viva Mortgage Platform™ is a crowdfunding platform that allows users to originate their mortgage capital requirement by connecting them with thousands of lenders from all around the world.

At Viva Network we believe in a free and fair market for all. We are motivated by the greater good to improve an unfair and centuries-old mortgage system that has been controlled by large banks for hundreds of years. We are here to take the profits that have typically fueled large monopolistic banks and return those profits back to the people. Our home financing system is better, faster and exponentially more inclusive and with your help, it can be the new standard of tomorrow.

BENEFITS FOR HOMEBUYERS

The benefits for homebuyers include; Lower mortgage rates, access to foreign capital, fast, easy & transparent, hybrid, user friendly platform.

The benefits for homebuyers include; Lower mortgage rates, access to foreign capital, fast, easy & transparent, hybrid, user friendly platform.

BENEFITS FOR INVESTORS

The benefits for investors include; Profitability, safety & assurance, liquidity, complete transparency.

The benefits for investors include; Profitability, safety & assurance, liquidity, complete transparency.

VIVANETWORK USE CASES

• Mortgage Seeker

• Private/institutional Investors

• Mortgage Arbitrage

• Mortgage Seeker

• Private/institutional Investors

• Mortgage Arbitrage

THE VIVANETWORK VISION

Viva wants to revolutionize the antiquated mortgage lending industry by cutting out the middlemen and decentralizing the process, thereby applying a fundamentally more accessible and transparent approach to financing. We believe that Viva’s technology will increase the availability of credit for borrowers and for the first time allow non-institutional investors to participate in the consistent, asset-backed returns associated with mortgage investments, a product that has traditionally been reserved solely for large financial institutions.

Viva wants to revolutionize the antiquated mortgage lending industry by cutting out the middlemen and decentralizing the process, thereby applying a fundamentally more accessible and transparent approach to financing. We believe that Viva’s technology will increase the availability of credit for borrowers and for the first time allow non-institutional investors to participate in the consistent, asset-backed returns associated with mortgage investments, a product that has traditionally been reserved solely for large financial institutions.

TOKEN DETAILS

VIVA - Token (ticker symbol)

4,000,000,000 VIVA - Total Supply

Company - VIVA Network Holdings Limited

Technology: ERC20 Ethereum blockchain based

TGE Distribution: 3,000,000,000 VIVA tokens distributed during the TGE

The unsold tokens will be burned automatically by the Smart Contract System

VIVA - Token (ticker symbol)

4,000,000,000 VIVA - Total Supply

Company - VIVA Network Holdings Limited

Technology: ERC20 Ethereum blockchain based

TGE Distribution: 3,000,000,000 VIVA tokens distributed during the TGE

The unsold tokens will be burned automatically by the Smart Contract System

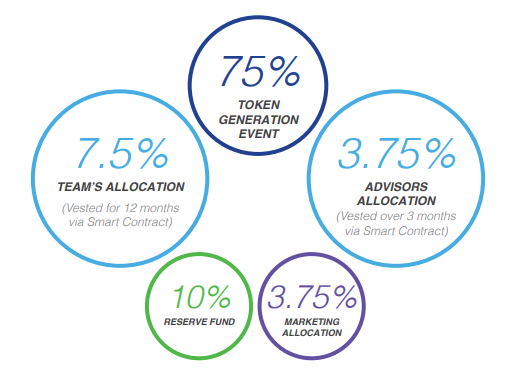

TOKEN DISTRIBUTION

75% - Token generation event distribution

7.5% - Team’s Allocation

3.75% - Advisors’ Allocation

3.75% - Marketing, bounty & private contribution allocation

10% - Reserve Fund Allocation

75% - Token generation event distribution

7.5% - Team’s Allocation

3.75% - Advisors’ Allocation

3.75% - Marketing, bounty & private contribution allocation

10% - Reserve Fund Allocation

ROADMAP

May 2016: Inception of initial idea - to create and utilize a blockchain based technology which enables global investors to crowdfund private mortgages, without the need of banks.

June 2017:

• Compiled an initial team of software engineers.

• Prototyping and exploration of Ethereum and wider blockchain ecosystem to identify suitable core technologies.

• High level, service-oriented architectural planning of the Viva Platform and scalable infrastructure.

August 2017:

• Extensive feasibility analysis in the form of acquiring advisors and other due diligence meetings.

• Exploratory data analysis

November 2017:

• Scrape home valuation, geographic, and other housing data for algorithmic analysis for the launch MVP in test market location.

• Developed the Real Value 1.0 Home Valuation Algorithm designed to value proposed residential real estate developments in our test market location.

Q1 & Q2 – 2018:

• Initiate marketing and promotional campaign

• Launch Token Generation Event.

• Launch the MVP – A web app designed to provide VIVA Token holders with the ability to preview the Viva Network Platform and use the Real Value 1.0 Home Valuation App.

• Hire a comprehensive team of software developers to be assigned to the development of The Viva Network Platform, including: Real Value 2.0 Home Valuation Application, Viva FMS Exchange Application, Mortgage listing system (Hub Platform), and mobile clients by using funds raised during the Early Contribution Period.

• Continued legal, regulatory and compliance due-diligence, including required licences and other regulatory hurdles required for the Viva Network Platform’s mortgage crowdfunding operation.

• Obtain extensive legal and regulatory procedural advice for the roll out of the Mortgage Crowdfunding system using funds raised during the Early Contribution Period.

Q3 – 2018:

• Complete the development of Real Value 2.0 Application

• In-depth architecture proposed and reviewed by third party auditors

• Establish end-user focus groups

• Complete selection of cloud infrastructure and development technology partners

• Upon completion of the Token Sale Event, our goal is for VIVA to become listed on multiple cryptocurrency exchanges, including at least one of the top five exchanges.

• Risk assessment and mortgage term recommendation ML algorithm design

• Customized investor portfolio suggestions recommendation algorithm design.

• Propose complete RESTful API specification

• Produce high-fidelity UI prototypes

Q4 – 2018:

• Launch Real Value 2.0 Application

• Agile iteration on product design towards main development phase

• Decoupled frontend vs. API development allows for early realistic user testing and observation

• Finalize proprietary ML algorithms with extensive back-testing and limitation/fairness analysis

• Complete development of algorithm based savings account technology. This software will use a financial algorithms and Fractionalized Mortgage Share derivatives with the intention being to provide users with an interest accruing savings account that is feasible, highly liquid, easy to use, and provides safe return for savers.

• Hire 5 regional directors to oversee operations in initial five countries.

• Establish disaster recovery protocol and scalability testing

• Complete system-wide security/privacy audit

Q1 – 2019

• Integrate with various proprietary software systems that allow for more efficient operations, eg. a decentralized credit rating system.

• Complete internal testing and quality assurance

• Finalize regulatory requirements in at least 5 countries identified as prime candidates for initial roll out of Viva Hubs.

• Obtain multinational utility and design patents on Viva Network’s proprietary technology and applications.

• Begin incremental launch of the Viva Network

• Begin integration strategy with third party fintech partners

• Integrate with third-party blockchain escrow services such as Serenity

• Integrate with mainstream automated (passive) investment services like Stash

Q2 – 2019:

• By this time, our goal is for the first mortgage to be underwritten and successfully crowdfunded using Viva Network Platform’s Fractionalized Mortgage Shares and the mortgage crowdfunding system as described in the White Paper.

• Identify scope for Viva Platform phase 2 release through usage analytics and customer feedback

May 2016: Inception of initial idea - to create and utilize a blockchain based technology which enables global investors to crowdfund private mortgages, without the need of banks.

June 2017:

• Compiled an initial team of software engineers.

• Prototyping and exploration of Ethereum and wider blockchain ecosystem to identify suitable core technologies.

• High level, service-oriented architectural planning of the Viva Platform and scalable infrastructure.

August 2017:

• Extensive feasibility analysis in the form of acquiring advisors and other due diligence meetings.

• Exploratory data analysis

November 2017:

• Scrape home valuation, geographic, and other housing data for algorithmic analysis for the launch MVP in test market location.

• Developed the Real Value 1.0 Home Valuation Algorithm designed to value proposed residential real estate developments in our test market location.

Q1 & Q2 – 2018:

• Initiate marketing and promotional campaign

• Launch Token Generation Event.

• Launch the MVP – A web app designed to provide VIVA Token holders with the ability to preview the Viva Network Platform and use the Real Value 1.0 Home Valuation App.

• Hire a comprehensive team of software developers to be assigned to the development of The Viva Network Platform, including: Real Value 2.0 Home Valuation Application, Viva FMS Exchange Application, Mortgage listing system (Hub Platform), and mobile clients by using funds raised during the Early Contribution Period.

• Continued legal, regulatory and compliance due-diligence, including required licences and other regulatory hurdles required for the Viva Network Platform’s mortgage crowdfunding operation.

• Obtain extensive legal and regulatory procedural advice for the roll out of the Mortgage Crowdfunding system using funds raised during the Early Contribution Period.

Q3 – 2018:

• Complete the development of Real Value 2.0 Application

• In-depth architecture proposed and reviewed by third party auditors

• Establish end-user focus groups

• Complete selection of cloud infrastructure and development technology partners

• Upon completion of the Token Sale Event, our goal is for VIVA to become listed on multiple cryptocurrency exchanges, including at least one of the top five exchanges.

• Risk assessment and mortgage term recommendation ML algorithm design

• Customized investor portfolio suggestions recommendation algorithm design.

• Propose complete RESTful API specification

• Produce high-fidelity UI prototypes

Q4 – 2018:

• Launch Real Value 2.0 Application

• Agile iteration on product design towards main development phase

• Decoupled frontend vs. API development allows for early realistic user testing and observation

• Finalize proprietary ML algorithms with extensive back-testing and limitation/fairness analysis

• Complete development of algorithm based savings account technology. This software will use a financial algorithms and Fractionalized Mortgage Share derivatives with the intention being to provide users with an interest accruing savings account that is feasible, highly liquid, easy to use, and provides safe return for savers.

• Hire 5 regional directors to oversee operations in initial five countries.

• Establish disaster recovery protocol and scalability testing

• Complete system-wide security/privacy audit

Q1 – 2019

• Integrate with various proprietary software systems that allow for more efficient operations, eg. a decentralized credit rating system.

• Complete internal testing and quality assurance

• Finalize regulatory requirements in at least 5 countries identified as prime candidates for initial roll out of Viva Hubs.

• Obtain multinational utility and design patents on Viva Network’s proprietary technology and applications.

• Begin incremental launch of the Viva Network

• Begin integration strategy with third party fintech partners

• Integrate with third-party blockchain escrow services such as Serenity

• Integrate with mainstream automated (passive) investment services like Stash

Q2 – 2019:

• By this time, our goal is for the first mortgage to be underwritten and successfully crowdfunded using Viva Network Platform’s Fractionalized Mortgage Shares and the mortgage crowdfunding system as described in the White Paper.

• Identify scope for Viva Platform phase 2 release through usage analytics and customer feedback

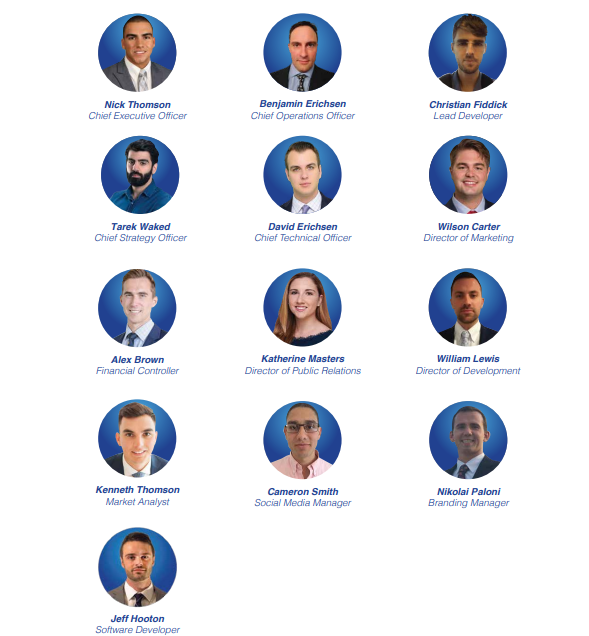

TEAM

Nick Thomson - Chief Executive Officer

Benjamin Erichsen - Chief Operations Officer

Christian Fiddick - Lead Developer

Tarek Waked - Chief Strategy Officer

David Erichsen - Chief Technical Officer

Wilson Carter - Director of Marketing

Alex Brown - Financial Controller

Katherine Masters - Director of Public Relations

William Lewis - Director of Development

Kenneth Thomson - Market Analyst

Cameron Smith - Social Media Manager

Nikolai Paloni - Branding Manager

Jeff Hooton - Software Developer

Nick Thomson - Chief Executive Officer

Benjamin Erichsen - Chief Operations Officer

Christian Fiddick - Lead Developer

Tarek Waked - Chief Strategy Officer

David Erichsen - Chief Technical Officer

Wilson Carter - Director of Marketing

Alex Brown - Financial Controller

Katherine Masters - Director of Public Relations

William Lewis - Director of Development

Kenneth Thomson - Market Analyst

Cameron Smith - Social Media Manager

Nikolai Paloni - Branding Manager

Jeff Hooton - Software Developer

ADVISORS

Real Estate Developer, Entrepreneur - Stephen Thomson

Corporate Banking, Senior Business Analyst - Stephen Mayor

Quantitative Developer - Kishan Sudusinghe

Risk Analyst - Jesse Beohm

Senior M&A Underwriter - Lance Fraser

Senior Risk Modeler - James Anfossi

Software Developer - Josh Hebb

Real Estate Developer, Entrepreneur - Stephen Thomson

Corporate Banking, Senior Business Analyst - Stephen Mayor

Quantitative Developer - Kishan Sudusinghe

Risk Analyst - Jesse Beohm

Senior M&A Underwriter - Lance Fraser

Senior Risk Modeler - James Anfossi

Software Developer - Josh Hebb

For more details on this project, please feel free to click on any of the following links:

Website: https://www.vivanetwork.org

Whitepaper: https://www.vivanetwork.org/pdf/whitepaper.pdf

Twitter: https://twitter.com/TheVivaNetwork

Telegram: http://t.me/Wearethevivanetwork

Facebook: https://www.facebook.com/VivaNetworkOfficial/

Reddit: https://www.reddit.com/r/TheVivaNetwork/

Medium

Website: https://www.vivanetwork.org

Whitepaper: https://www.vivanetwork.org/pdf/whitepaper.pdf

Twitter: https://twitter.com/TheVivaNetwork

Telegram: http://t.me/Wearethevivanetwork

Facebook: https://www.facebook.com/VivaNetworkOfficial/

Reddit: https://www.reddit.com/r/TheVivaNetwork/

Medium

My:Siapuntuktempur

Tidak ada komentar:

Posting Komentar