UNICAP

• Introduction of CETF

A Crypto Exchange Fund (CETF) is a type of fund and an exchange traded product, meaning they are traded on crypto exchanges. CETFs are a lot like mutual funds, except that CETFs are bought and sold within 24 hours on cryptocurrency exchanges. The CETF holds assets such as cryptocurrencies, tokens, coins, and typically operates with an arbitrage mechanism designed to keep trading close to its net worth, although deviations can sometimes occur.

The CETF divides ownership of itself into tokens owned by token holders. Token holders indirectly own the assets of the fund. Token holders are entitled to a share of the profits and they will be entitled to any residual value if the fund is liquidated.

CETFs can be attractive investments because of their low cost, asset pool and tradability. Source: https://en.wikipedia.org/wiki/Exchange-traded_fund

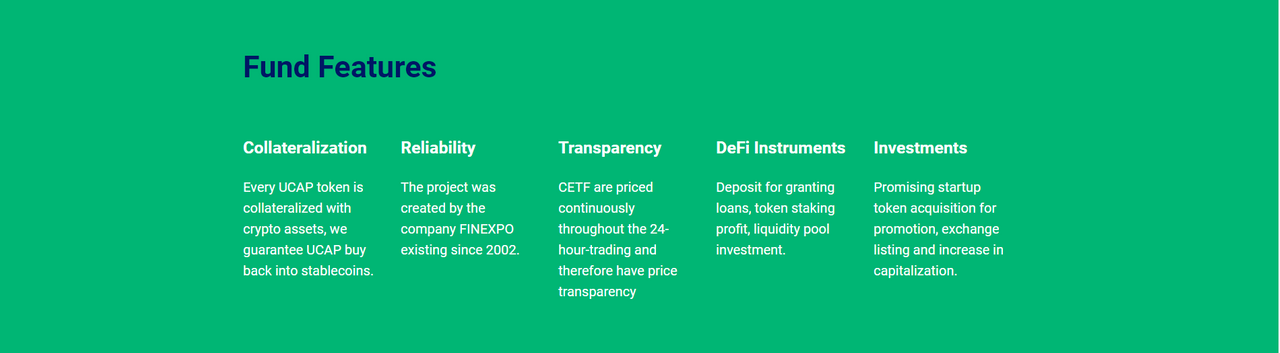

• With security

You do not buy a token, but collectively invest in the fund, exchanging your funds for UCAP tokens. Your funds are deposited in fund accounts and all transactions are transparent. This is why each UCAP token will initially be 90% backed by real cryptocurrency and swap liquidity tokens.

• Reliability

The project was created by FINEXPO, which has existed since 2002. The main FINEXPO projects are exhibitions and exhibitions of luxury goods held annually around the world. These events were attended by more than 200,000 visitors and 3,000 companies around the world. The company also owns IQ.cash and Master.Money. The geography of these exhibitions is really extensive and covers the following countries: Thailand, Malaysia, Indonesia, Singapore, Vietnam, India, Egypt, Cyprus, China, Philippines, Kazakhstan, Russia, Ukraine, Slovakia, Latvia, etc.

• Transparency

CETF is transparent. CETF prices are set continuously during 24-hour trading so they are transparent.

• Trade

CETF can be bought and sold at current market prices at any time within 24 hours. In addition, investors can execute the same types of trades as with cryptocurrencies, such as limit orders, which allow investors to specify the price points at which they are willing to trade, stop loss orders, margin buy, hedging strategies, and no minimum investment requirements. ... Because CETFs can be bought, held and sold cheaply, some investors buy and hold CETFs for asset allocation purposes, while other investors often trade CETF stocks to hedge risks or implement market time investment strategies.

Market exposure and diversification

CETF can provide some level of diversification. CETF provides an economical way to rebalance portfolio allocations and quickly invest cash.

Problem

Most coin and token owners (investors) face:

● No additional passive income.

● Inability to create a profile from multiple tokens / coins and manage it professionally.

● Loss of time and resources during day trading. Training and adaptation to artificial intelligence systems.

● Commission losses.

● We constantly monitor new trends and decide whether to buy promising tokens and coins or not.

In their quest for profits, they are starting to look at the fast-growing startups DeFI. However, here they notice that most DeFi tokens do not have real business, but only expectations of how successful the project will be, so they can easily increase and probably fall in value easily.

The difference in the market can reach 1-100-1 dollars, so only the founders receive income from it. All projects do not send real profits to investors, so many of them fall into the scam category. We analyzed the market and created a safe, profitable and transparent UNICAP project.

A financial fund with the DeFi ecosystem to generate additional profit from your dormant cryptoassets. Investors can only solve these problems, start increasing profits and receive a stable income by creating a crypto fund (collective investment). We have created a secure exchange token UCAP, which is provided to you in lieu of investments under the UNICAP fund.

You do not buy a token, but collectively invest in the fund, exchanging your funds for UCAP tokens. Your funds are deposited in fund accounts and all transactions are transparent. This is why each UCAP token will initially be 90% backed by real cryptocurrency and swap liquidity tokens. 10% will be reserved by the company's management for control, development, listing on leading stock exchanges and advertising of the project. The profits from the operation of the DeFi ecosystem will be additionally directed to the fund, which will increase the value of the token and cover the initial costs of managing the fund, as well as the growth of the fund's market value.

The exchange of tokens for your funds is planned to be multi-level (at least 90 levels). The price will increase by $ 0.1 each next level (300,000 - 1,000,000 tokens)! After preliminary public levels of swap and listing, tokens will be exchanged / sold at the price set by the exchange, but not below the current level. The initial price of $ 1 will rise to over $ 20 by the end of the placement of all tokens, which will bring a good profit to the first investors of the fund.

The ability to exchange UCAP tokens for the Buy Back Fund will be available at the following levels (after listing), or you can use the token as a financial instrument for part of all funds for pools or exchange trading. UCAP “Buyback” swap - all tokens that will be returned to the fund will be frozen and exchanged / sold for cryptocurrency in the future after level 90! Swap "Buyback" 5% of the commission for replenishment. The minimum swap “Buyback” is 10,000 USDT. UCAP Swap Price = Net Worth / Token Turnover

Tokens will be listed on leading exchanges (Bittrex, OKEX, Huobi, Binance, FTX, BitHumb, UpBit, BitFinex, etc.) after the Pre Public Swap period. Liquidity pools will be created across all leading DeFi platforms.

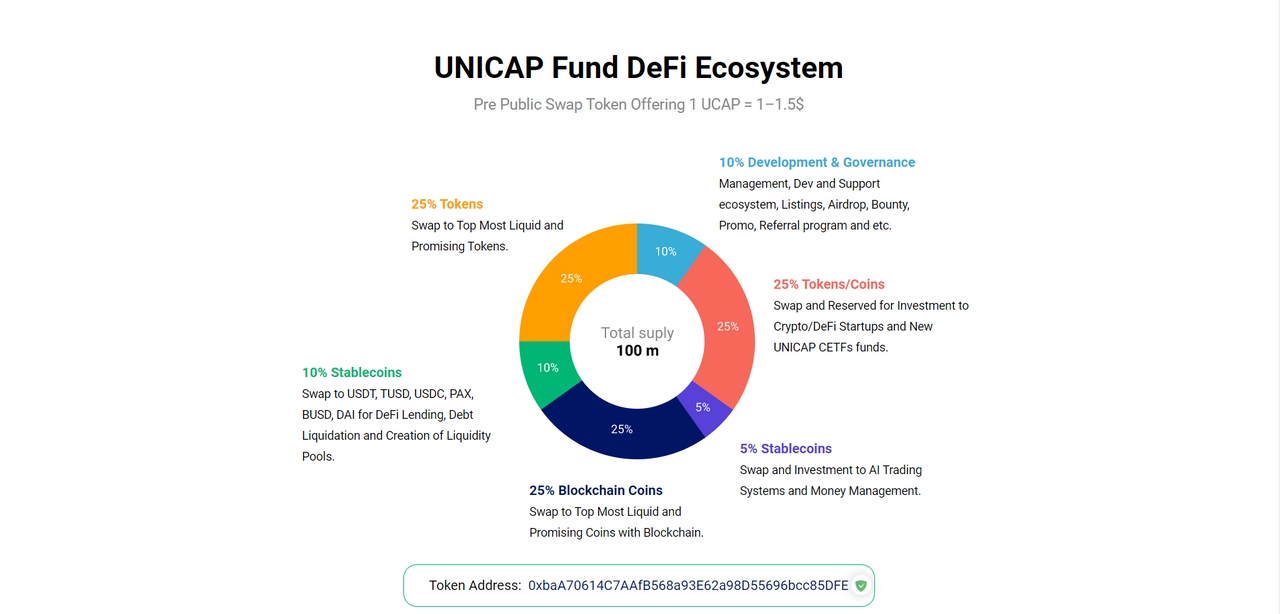

Allocation of UCAP proposal 10% / 90%

● 10%: development and management

● 90%: UNICAP project

Allocation of UNICAP fund resources:

● 5% stablecoins.

AI investment trading systems and money management USDT, TUSD, USDC, PAX, BUSD, DAI. Placing funds in the form of a stablecoin for trading in an artificial intelligence system. Short-term trading is day trading. Trading futures, options and synthetic instruments.

● 25% reserved for investment in Crypto / DeFi startups and new UNICAP CETF funds.

Prospective exchange of a start-up token / coin for a UCAP token for project development, partnership listing and capitalization increase to further increase the fund's profit and capitalization. UCAP token holders are slated to vote to invest in startups.

● 10% stablecoins.

USDT, TUSD, USDC, PAX, BUSD, DAI for DeFi lending, debt repayment and liquidity pools creation.

● 25% of Blockchain coins.

Top most liquid and promising blockchain coins. Profile management. Rotation of funds to increase liquidity and capitalization by replacing inactive ones or decreasing them with more promising ones in terms of fund policy.

● 25% tokens (any platform).

Top most liquid and promising tokens. Profile management. Rotation of funds to increase liquidity and capitalization by replacing inactive ones or decreasing them with more promising ones in terms of fund policy.

• UNICAP ecosystem

UNICAP

Azka (39) in #bitcoin • 18 hours ago

image.png

Introduction of CETF

A Crypto Exchange Fund (CETF) is a type of fund and an exchange traded product, that is, they are traded on crypto exchanges. CETFs are a lot like mutual funds, except that CETFs are bought and sold within 24 hours on cryptocurrency exchanges. The CETF holds assets such as cryptocurrencies, tokens, coins, and typically operates with an arbitrage mechanism designed to keep trading close to its net worth, although deviations can sometimes occur.

The CETF divides ownership of itself into tokens owned by token holders. Token holders indirectly own the assets of the fund. Token holders are entitled to a share of the profits and they will be entitled to any residual value if the fund is liquidated.

CETFs can be attractive investments because of their low cost, asset pool and tradability. Source: https://en.wikipedia.org/wiki/Exchange-traded_fund

With collateral,

you do not buy a token, but collectively invest in the fund, exchanging your funds for UCAP tokens. Your funds are deposited in fund accounts and all transactions are transparent. This is why each UCAP token will initially be 90% backed by real cryptocurrency and swap liquidity tokens.

Reliability

The project was created by FINEXPO, which has existed since 2002. The main FINEXPO projects are exhibitions and exhibitions of luxury goods, held annually around the world. These events were attended by more than 200,000 visitors and 3,000 companies around the world. The company also owns IQ.cash and Master.Money. The geography of these exhibitions is really extensive and covers the following countries: Thailand, Malaysia, Indonesia, Singapore, Vietnam, India, Egypt, Cyprus, China, Philippines, Kazakhstan, Russia, Ukraine, Slovakia, Latvia, etc.

image.png

Transparency

CETF is transparent. CETF prices are set continuously during 24-hour trading, so they are transparent.

Trade

CETF be bought and sold at current market prices at any time within 24 hours. In addition, investors can execute the same types of trades as with cryptocurrencies, such as limit orders that allow investors to specify the price points at which they are willing to trade, stop loss orders, margin buy, hedging strategies, and no minimum investment requirements. ... Because CETFs can be bought, held and sold cheaply, some investors buy and hold CETFs for asset allocation purposes, while other investors often trade CETF stocks to hedge risks or implement market time investment strategies.

image.png

Market exposure and diversification

CETF can provide some level of diversification. CETF provides an economical way to rebalance portfolio allocations and quickly invest cash.

Problem

Most coin and token owners (investors) face:

● No additional passive income.

● Inability to create a profile from multiple tokens / coins and manage it professionally.

● Loss of time and resources during day trading. Training and adaptation to artificial intelligence systems.

● Commission losses.

● We constantly monitor new trends and decide whether to buy promising tokens and coins or not.

In their quest for profits, they are starting to look at the fast-growing startups DeFI. However, here they notice that most DeFi tokens do not have real business, but only expectations of how successful the project will be, so they can easily increase and probably fall in value easily.

The difference in the market can reach 1-100-1 dollars, so only the founders receive income from it. All projects do not send real profits to investors, so many of them fall into the scam category. We analyzed the market and created a safe, profitable and transparent UNICAP project.

A financial fund with the DeFi ecosystem to generate additional profit from your dormant cryptoassets. Investors can only solve these problems, start increasing profits and receive a stable income by creating a crypto fund (collective investment). We have created a secure exchange token UCAP, which is provided to you in lieu of investments under the UNICAP fund.

You do not buy a token, but collectively invest in the fund, exchanging your funds for UCAP tokens. Your funds are deposited in fund accounts and all transactions are transparent. This is why each UCAP token will initially be 90% backed by real cryptocurrency and swap liquidity tokens. 10% will be reserved by the company's management for control, development, listing on leading stock exchanges and advertising of the project. The profits from the operation of the DeFi ecosystem will be additionally directed to the fund, which will increase the value of the token and cover the initial costs of managing the fund, as well as the growth of the fund's market value.

The exchange of tokens for your funds is planned to be multi-level (at least 90 levels). The price will increase by $ 0.1 each next level (300,000 - 1,000,000 tokens)! After preliminary public levels of swap and listing, tokens will be exchanged / sold at the price set by the exchange, but not below the current level. The initial price of $ 1 will rise to over $ 20 by the end of the placement of all tokens, which will bring a good profit to the first investors of the fund.

The ability to exchange UCAP tokens for the Buy Back Fund will be available at the following levels (after listing), or you can use the token as a financial instrument for part of all funds for pools or exchange trading. UCAP “Buyback” swap - all tokens that will be returned to the fund will be frozen and exchanged / sold for cryptocurrency in the future after level 90! Swap "Buyback" 5% of the commission for replenishment. The minimum swap “Buyback” is 10,000 USDT. UCAP Swap Price = Net Worth / Token Turnover

Tokens will be listed on leading exchanges (Bittrex, OKEX, Huobi, Binance, FTX, BitHumb, UpBit, BitFinex, etc.) after the Pre Public Swap period. Liquidity pools will be created across all leading DeFi platforms.

Allocation of UCAP proposal 10% / 90%

● 10%: development and management

● 90%: UNICAP project

Allocation of UNICAP fund resources:

● 5% stablecoins.

AI investment trading systems and money management USDT, TUSD, USDC, PAX, BUSD, DAI. Placing funds in the form of a stablecoin for trading in an artificial intelligence system. Short-term trading is day trading. Trading futures, options and synthetic instruments.

● 25% reserved for investment in Crypto / DeFi startups and new UNICAP CETF funds.

Prospective exchange of a start-up token / coin for a UCAP token for project development, partnership listing and capitalization increase to further increase the fund's profit and capitalization. UCAP token holders are slated to vote to invest in startups.

● 10% stablecoins.

USDT, TUSD, USDC, PAX, BUSD, DAI for DeFi lending, debt repayment and liquidity pools creation.

● 25% of Blockchain coins.

Top most liquid and promising blockchain coins. Profile management. Rotation of funds to increase liquidity and capitalization by replacing inactive ones or decreasing them with more promising ones in terms of fund policy.

● 25% tokens (any platform).

Top most liquid and promising tokens. Profile management. Rotation of funds to increase liquidity and capitalization by replacing inactive ones or decreasing them with more promising ones in terms of fund policy.

Ecosystem UNICAP

image.png

Token characteristics and distribution of sales

● Token ticker: UCAP

● Token type: ERC-20

● Blockchain: Ethereum

● Legal classification: utility token.

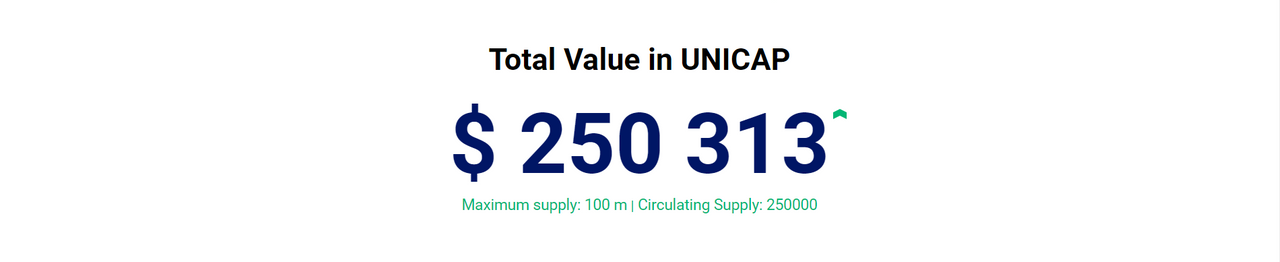

● Total supply (number of tokens): 100,000,000

Private Swap: 250,000 UCAP (0.20%) at $ 0.8 per UCAP

● Pre Public Swap Level 1: 300,000 UCAP (0.30%) at Price 0, USD 8–1 per UCAP

● Pre Public Swap Level 2: 500,000 UCAP (0.50%) at USD 0.9–1.1 per UCAP

● Pre Public Swap Level 3: 500,000 UCAP (0.50 %) at a price of USD 1–1.2 per UCAP.

● Sales level 4: 500,000 UCAP (1%) at $ 1.1-1.3 per UCAP.

● Sales level 5: 500,000 UCAP (1%) at $ 1.2-1.4 per UCAP.

● Sales level 6: 1,000,000 UCAP (1%) at $ 1.3–1.5 per UCAP.

● Sales level 7–100: 1,000,000 UCAP (1%) each level at $ 1.4–20 per UCAP.

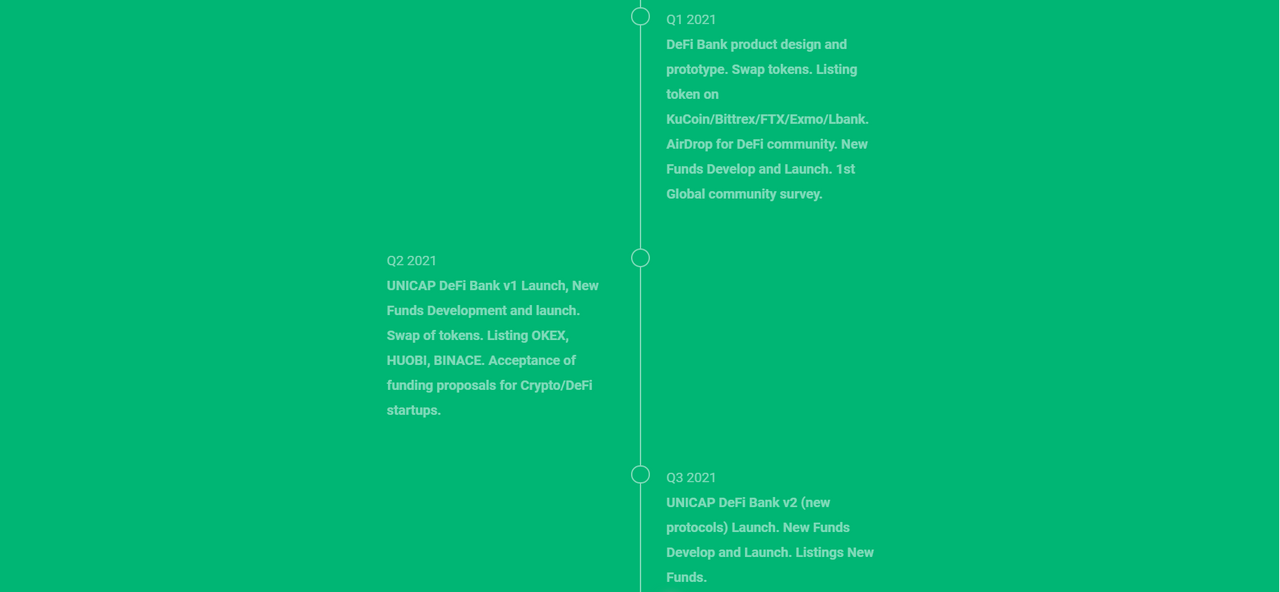

• Road map

For clearer information, follow the link below:

● Website: https://ucap.finance/

● UNICAP_WP: https://ucap.finance/docs/ucap_wp_v1.pdf

● Telegram: https://t.me / unicap_finance

● Facebook: https://facebook.com/tradersfair

● Twitter: https://twitter.com/unicapfinance

● Linkedin: https://www.linkedin.com/showcase/unicapfinance/

● Discord: https: // discord.gg/BJBA4Yb

Name:Bayanganhitam

https://bitcointalk.org/index.php?action=profile;u=2851798;sa=summary

Tidak ada komentar:

Posting Komentar